A project started by the previous Pakistani Prime minister Nawaz Sharif in 2013 is known as the Prime Minister’s Youth Program (known as the Kamyab Jawan Program from 2019 to 2022). The program’s goal is to provide adolescents with meaningful jobs and high-quality education through coordinated, long-term youth activities. The initiative also included a national youth council, a talent search for young athletes, and a skills scholarship program.

This article will give you detailed information about Youth Loan Scheme.

The superior government’s youth loan program have the following parts of the program included

The total amount of 20 billion was to be distributed over 5 years. The government distributed 3.5 billion for 1 million people in all over the country to get interest free loans of up to Rs. 50,000. Women will also be benefitted with the half. The loans would be given by the (PPAF). In all over the countries specific centers, and business help centers were to be built. Apply Now for the Kamyab Jawan Program New Updates.

A government program or financial institution effort designed to give money to young people, entrepreneurs or among youth by providing business loans on simple terms and with less markup through 15 commercial, Islamic and SME banks to boost their business endeavors or initiatives will likely still be referred to as a youth loan scheme in 2024. The core objectives of the program are still to promote youth entrepreneurship, support job creation, and promote economic growth.

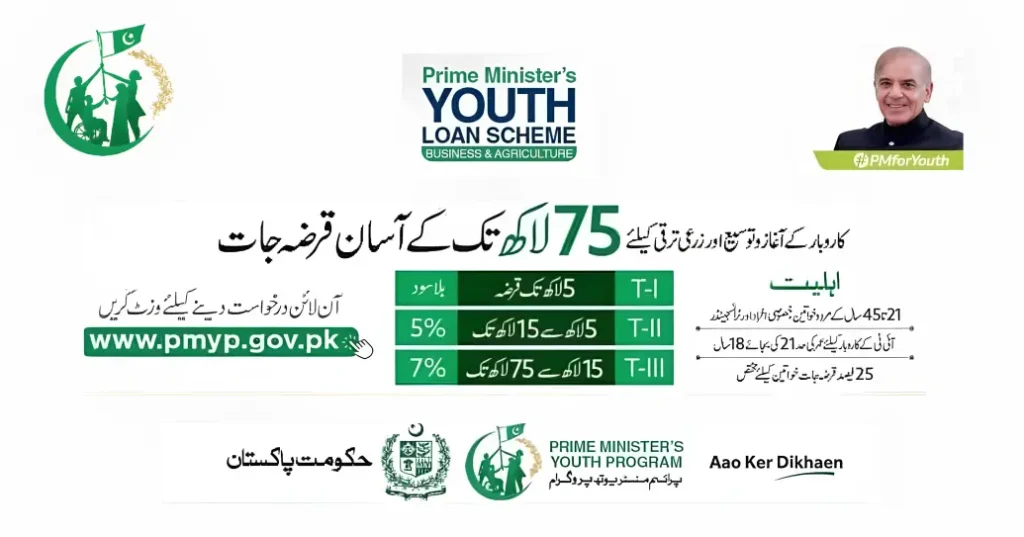

People aged 21 to 45 can qualify for a loan of up to 75 lakh under the Prime Minister’s Youth Loan Scheme. However, for those interested in the IT and e-commerce sectors, the minimum age requirement is 18. There will be no interest costs on loans up to PKR 0.5 million. There will be no interest charged on the maximum borrowing amount of PKR 0.5 million.

As of 2018, the Pakistan Tehreek-e-Insaf (Pakistan Movement for Justice) administration had discontinued the Prime Minister Laptop Scheme and other schemes. The Imran Khan ministry renamed the Prime Minister’s Youth Program to the Kamyab Jawan Program in September 2019 then following a suspension in disbursements beginning in July 2022, the Shahbaz Sharif government renamed it back in December 2022.

Features

Age Limitation

Youth loan scheme fix the age group. People must be between the age 21-45 years old. The lower age limit will be taking years or equalant matriculation.

Financing Help

The second feature of the youth loan scheme is to facilitate with financial help to young entrepreneurs who has desired to expand their business. The scheme will provide loans at lower interest rates along with reasonable payment conditions.

Types of Loans

The schemes have two types of loans.

Start-up Loans

It means a loan for new business.

Expansions Loans

Loan for such peoples who want to improve present enterprises.

Beneficial Loan Conditions

Low interest rates, longer re-payment periods, and longer security requirements make to access of financing easier.

Eligibility Criteria

The citizen would be able to apply the loan having the age, educational qualifications, valid business plans according to the schemes requirements.

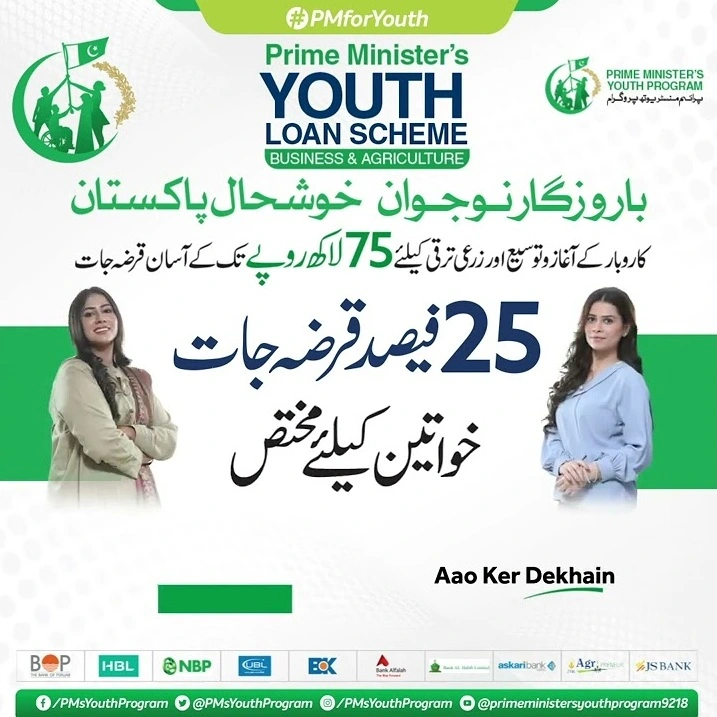

Inclusivity and Diversity

Youth Loan Scheme promotes inclusivity and encourage applications from individuals from diverse backgrounds including women and marginalized communities.

Loan Amount

The loan amount will depending on the demands and requirements of the company project or enterprise. Some plans have a maximum loan amount however, others may be flexible in terms of loan size.

Application Process

The application process for a youth loan program often include providing a detailed business plan as well as other relevant papers. Interviews or assessments may be conducted as part of the evaluation and approval process to guarantee the viability of the company proposal.

Process of Repayment

The repayment arrangement is typically meant to be manageable for young entrepreneurs. It may include monthly or quarterly installments over a certain length of time, allowing borrowers to repay the loan without excessive financial hardship. People Also Search Ehsaas Interest-Free Loan Program Online Apply

Who are eligible for this scheme?

Following are eligible for Youth Loan Scheme

Who are not eligible for this scheme?

Benefits of Youth Loan Scheme

Job Opportunities

The scheme provides jobs creation and built up the Youth-led companies from which they reduce unemployment.

Independent business

Empowerment gives financial resources to young businessman to follow their business aspiration, creating independency.

Profitable Growth

If the person succeeded in his business. By paying tax and investing he can contribute in the economy.

Encouragement

Ambitious ideas and solutions by Young minds can produce unimaginable growth in various industries.

Social outcomes

In further, socially responsible business enterprises that meet the community needs and environmental problems.

Reduced Dependency

It gives persons self sufficiency and shorten reliance on government aid programs . Avail of your Health Program with Sehat Insaf Card.

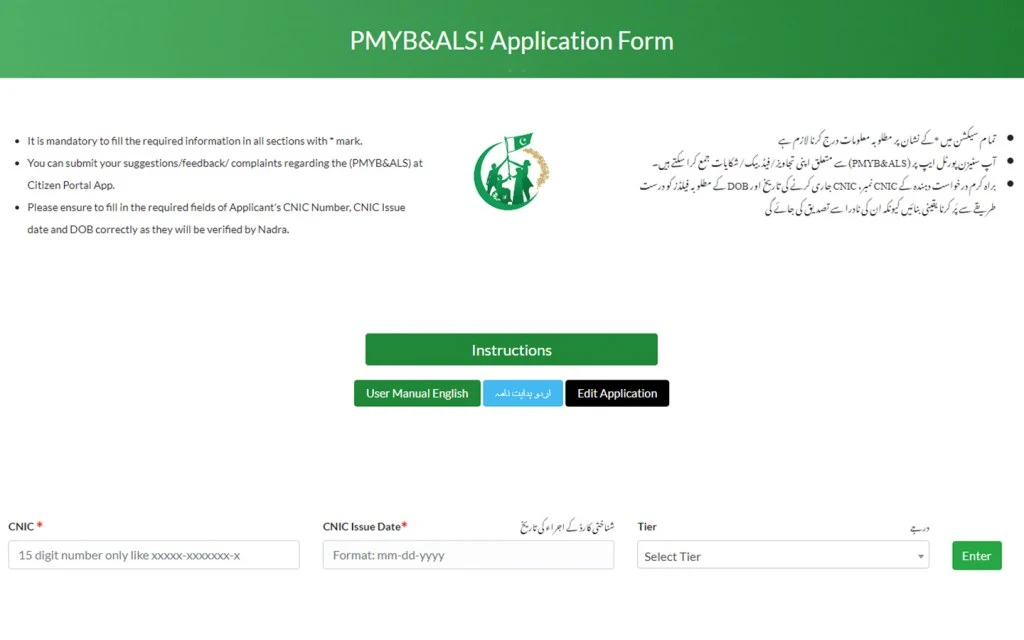

How to Apply for Youth Loan Scheme?

All applications have to submit online. No physical application allowed. Following documents are required for registration

The required information are mentioned here

FAQ’s

Who is Eligible to Apply?

All men and women with entrepreneurial potential aspire to work for themselves.

How much is the loan?

The loan amount is divided into three tiers, as follows:

Tier 1 (T1) loans range from Rs 100,000 to Rs 1 million.

Tier 2 (T2) loans range from Rs 1 million to Rs 10 million.

Tier 3 (T3) loans range from Rs 10 million to Rs 25 million.

Can I apply for a vehicle?

Yes, locally built commercial cars.

How will the loan be repaid?

Monthly installments following the grace period (if any).

Final Verdict

The youth loan scheme, a transformative effort aiming at providing financial help to young entrepreneurs, has concluded successfully. It has enabled aspirational youth to realize their aspirations, enhance economic growth, and create a promising future by fostering creativity and entrepreneurial spirit. Its good impact on the economy and young people’s hopes will be remembered for years to come.