Good news for Pakistanis, as the Government of Pakistan, in collaboration with the Poverty Alleviation & Social Safety Division and National Poverty Graduation Initiative, has opened the Online Registration for Ehsaas Interest-Free Loan 2024.

If you’re falling on the Government’s Poverty Score and have a Business or Education Plan, apply online for the Ehsaas Loan or Ehsaas Bila Sood Qarza Program from our website and claim 75,000 PKR/month with zero interest.

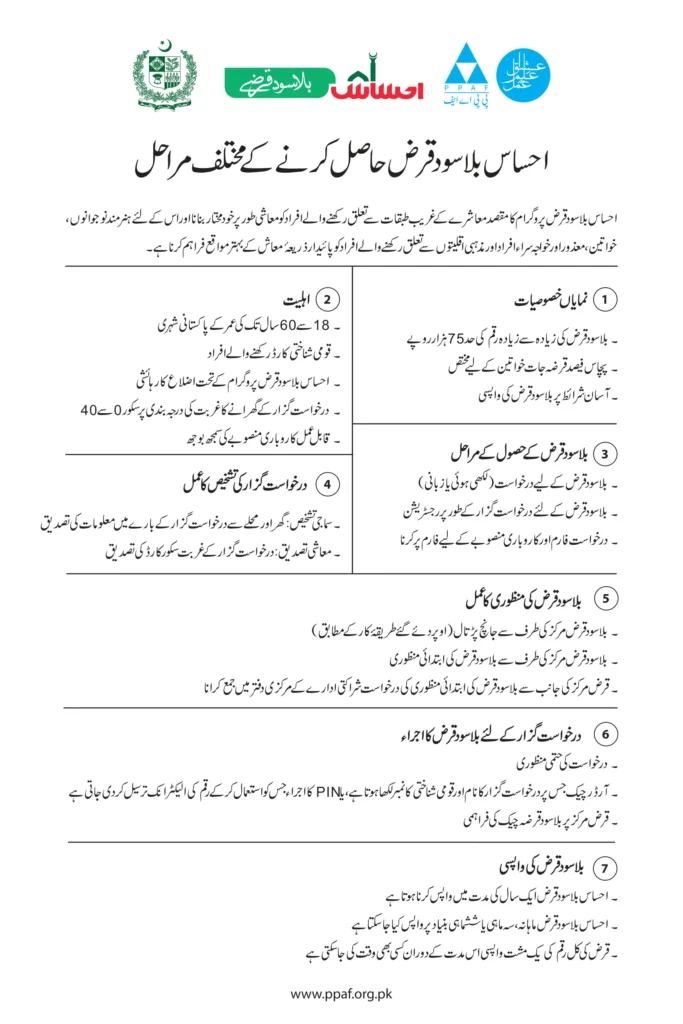

For the Ehsaas Loan 2024 Registration Phase, the Government has allocated 50% of the Ehsaas Loan total budget for Women, Transgender, and Disable Persons, while the remaining will rightfully distribute among skilled youth and deserving families.

Whether you want to apply for the Ehsaas Loan Program or need information about the scheme’s qualification, process, or registration, this article will provide comprehensive details on this particular Ehsaas Program. Apply for Sehat Card Program New Registrations Started.

What is Ehsaas Interest Free Loan – Exploring the Details

The globally increasing inflation has directly impacted a prime portion of Pakistan’s population, and the conditions worsened after COVID-19. In the meantime, the Government worked extremely hard to alleviate poverty, empower marginalized communities, and promote financial inclusion.

Following the typical strategy, each newly elected Government promises to cope with this National Issue by starting Social Welfare Schemes. Among other projects, Ex-Prime Minister Imran Khan’s Ehsaas Program stands at the top for maximum potential outcomes.

In the spotlight, Ehsaas Program is a Nationwide Spread Social Assistance Venture that aims to uplift vulnerable and marginalized segments of society. The Scheme packs a range of subsidiary programs, such as Ehsaas Rashan, Ehsaas, Bahimat Buzurg, Ehsaas Loan, and many more.

If we specifically talk about Ehsaas Interest-Free Loan, it is a Financial Aid Project under which eligible individuals can avail themselves of small loans without any interest or markup. Meanwhile, the repayment of the loans is structured affordably, considering the borrower’s income and financial capacity.

Read Also 8171 Ehsaas Tracking Pass New Update.

Potential Targets Behind Ehsaas Interest-Free Loan 2024

Like most Finance-targeted Welfare Programs, the Executing Departments of the Ehsaas Interest-Free Loan Scheme have set potential goals that must garner in-between pre-determined phases. The following are the salient targets of this Project.

Eligibility Criteria for Ehsaas Loan Program

To maintain Ehsaas Loan Program Transparent and Corruption-Free, the Federal Government has set Fixed Eligibility Standards for the desired applicants for this scheme. Of course, the Concerned Department always considers BISP Surveys, Nadra Records, and Concerned Banks’ Evaluation Reports on every application before the disbursement of loans.

How to Apply for Ehsaas Interest Free Loan

Applying for an Ehsaas Interest-Free Loan is a straightforward and transparent process designed to prioritize accessibility for all. As of the 2024 Registration Phase, Potential Borrowers can utilize two mediums to participate in this scheme.

Ehsaas Interest Free Loan Apply Online

Since a prime portion of Pakistan’s population has SmartPhones, the Government has introduced an Online Application Portal for Ehsaas Loans, which is convenient and allows applicants to get enrolled in this project with a hassle-free experience.

Ehsaas Interest Free Loan via Application

Ehsaas Loan Program aims to facilitate individuals from all backgrounds, allowing them to apply for the Scheme directly by submitting Applications by Hand at Loan Centers. Of course, this way, people having no connections to the internet or technology can claim their rights.

Applications Filtration Process of Ehsaas Program

One of the core reasons behind the Ehsaas Program’s utmost success is its Transparency, and Ehsaas Loan Scheme is no exception. The concerned departments consider and evaluate every application before selecting or rejecting it.

Ehsaas Interest Free Loan Application Process

Initially, submit your Loan Application using one of the two methods above. Shortly, you’ll receive an SMS carrying your current status. Meanwhile, a Loan Officer will contact you in two to four weeks if your application is approved.

Ehsaas Business Loan Preparation

Ehsaas Business Loan Program aims to facilitate Light-Minded People with Financial Aid so they can start their Business Initiatives. However, desired individuals must have proper start-up plans with calculated outcomes for approval of loans. Register Now for Bahimat Buzurg Program Online.

Ehsaas Loan Program Evaluation Process

After submitting your application, the dedicated team at Ehsaas will carefully evaluate it, considering your poverty score, financial matters, loan purpose, and supporting documents. Indeed, the entire procedure takes two to four weeks.

Ehsaas Loan Program Application Approval Process

If your application is approved, you’ll receive a Call from the Loan Officer on your Provided Mobile Number. After that, visit the asked Bank to follow the assigned method to claim your Loan. It is worth mentioning that you must accept the loan offer before disbursement of funds.

Ehsaas Loan Program Disbursement of Funds

Finally, you can visit the Loan Center or the Bank from which you have received a confirmation call to sign Loan Agreement. After agreeing with the terms and conditions, the Loan Amount will be disbursed in your account within two to three days.

Wrapping Up

In conclusion, the Ehsaas Interest-Free Loan program brings hope and opportunity for individuals seeking financial support to pursue their dreams. Of course, the Government has left no stone unturned in revolutionizing the accessibility and convenience of applying for loans, making it easier for people from all classes. In addition, a transparent work mechanism ensures consideration of applications without discrimination.

Read Also Ehsaas Kafalat Program Online Registration.